In the realm of finance, where numbers rule and decisions are made on the basis of meticulous analysis, the accounting equation stands as a beacon of clarity amidst the complexities of financial data. It serves as the cornerstone of financial analysis, providing a framework for understanding the relationship between a company’s assets, liabilities, and equity. In this comprehensive guide, we delve deep into the heart of financial analysis to unravel the mysteries of the accounting equation and explore its profound implications for businesses and investors alike.

What is the Accounting Equation?

Definition and Concept

At its core, the accounting equation encapsulates the fundamental principle of double-entry bookkeeping, which states that every financial transaction has equal and opposite effects on a company’s assets, liabilities, and equity. This foundational concept forms the basis for accurate record-keeping and financial reporting.

Components of the Accounting Equation

Assets

The economic resources owned or controlled by a company, including tangible assets such as cash, inventory, and property, as well as intangible assets such as patents and trademarks.

Liabilities – Accounting Equation

The financial obligations or debts owed by a company to external parties, such as loans, accounts payable, and accrued expenses.

Equity

The residual interest in the assets of a company after deducting its liabilities, represents the ownership stake of the shareholders or owners.

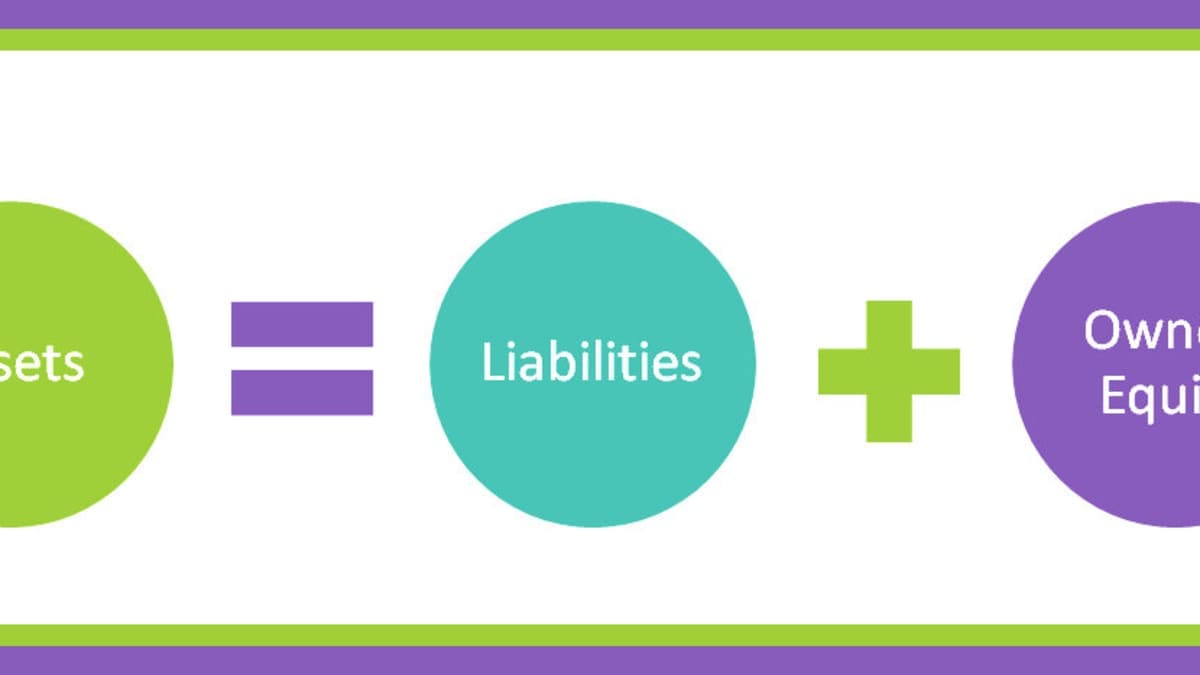

Formula of the Accounting Equation

The accounting equation is expressed mathematically as follows:

Assets = Liabilities + Equity

This equation illustrates the fundamental balance between a company’s resources (assets) and the claims against those resources (liabilities and equity).

Importance in Financial Reporting

The accounting equation serves as the basis for preparing key financial statements, including the balance sheet, income statement, and cash flow statement. By ensuring that the equation remains in balance, businesses can provide stakeholders with accurate and reliable information about their financial position and performance.

Assets: The Building Blocks of the Accounting Equation

Definition and Types of Assets

Assets are the lifeblood of any business, enabling it to generate revenue and create value for its stakeholders. They can be classified into various categories, including current assets (e.g., cash, accounts receivable) and non-current assets (e.g., property, plant, and equipment).

Tangible vs. Intangible Assets – Accounting Equation

Tangible assets have physical substance and can be touched or felt, such as machinery and equipment, while intangible assets lack physical presence but possess economic value, such as patents, copyrights, and goodwill

Examples of assets include:

Cash and cash equivalents

Accounts receivable

Inventory

Property, plant, and equipment

Investments

Valuation and Measurement of Assets

Assets are recorded on the balance sheet at their historical cost or fair market value, depending on the accounting principles applied (e.g., Generally Accepted Accounting Principles [GAAP] or International Financial Reporting Standards [IFRS]). Valuation methods may include historical cost, market value, or discounted cash flow analysis.

Impact on the Accounting Equation

Any increase or decrease in assets will have a corresponding effect on the other components of the accounting equation. For example, if a company purchases inventory with cash, its assets (inventory) will increase while its cash holdings will decrease, maintaining the balance of the equation.

Liabilities: Accounting Equation

Definition and Types of Liabilities

Liabilities represent the financial obligations or debts owed by a company to external parties, such as lenders, suppliers, and creditors. They can be classified into current liabilities (due within one year) and non-current liabilities (due after one year).

Current vs. Non-current Liabilities

Current liabilities include obligations such as accounts payable, accrued expenses, and short-term loans, while non-current liabilities encompass long-term debts, deferred tax liabilities, and pension obligations.

Examples of liabilities include:

Accounts payable

Short-term loans

Accrued expenses

Bonds payable

Deferred revenue

Measurement and Recognition of Liabilities

Liabilities are recorded on the balance sheet at their estimated settlement amounts, which may involve assessing future cash flows, interest rates, and other relevant factors. Recognition of liabilities occurs when a company incurs an obligation as a result of past transactions or events.

Impact on the Accounting Equation

Like assets, liabilities play a crucial role in maintaining the balance of the accounting equation. Any increase or decrease in liabilities will be offset by corresponding changes in assets or equity, ensuring that the equation remains in equilibrium.

Equity: The Owner’s Stake in the Business

Definition and Components of Equity

Equity represents the ownership interest of the shareholders or owners in a company’s assets after deducting its liabilities. It comprises various components, including:

Common stock – Accounting Equation

Represents the equity capital contributed by shareholders in exchange for ownership rights.

Retained earnings

Reflects the cumulative net income earned by the company that has not been distributed as dividends.

Additional paid-in capital

Represents the excess of the issue price of stock over its par value, if applicable.

Treasury stock: Represents shares of the company’s own stock that have been repurchased and are held in treasury.

Common Stock vs. Retained Earnings – Accounting Equation

Common stock represents the initial capital invested by shareholders, while retained earnings reflect the company’s accumulated profits that have been reinvested in the business rather than distributed to shareholders as dividends.

Shareholder’s Equity vs. Owner’s Equity

Shareholder’s equity refers specifically to the equity held by shareholders in a publicly traded company, while owner’s equity encompasses the equity held by the owners (e.g., sole proprietor, partners) of a privately held business.

Factors Affecting Equity

Equity can be influenced by various factors, including:

Issuance of new shares

Payment of dividends

Net income or loss

Changes in accounting policies or estimates

Impact on the Accounting Equation

Equity represents the residual claim on a company’s assets after satisfying its liabilities, and any changes in equity will affect the balance of the accounting equation. For example, if a company generates profits, its retained earnings will increase, thereby boosting its equity position.

Applications of the Accounting Equation

Financial Statement Preparation

Balance Sheet

The balance sheet provides a snapshot of a company’s financial position at a specific point in time, showing its assets, liabilities, and equity.

Income Statement – Accounting Equation

The income statement summarizes a company’s revenues, expenses, and net income or loss over a period of time, reflecting its profitability.

Cash Flow Statement

The cash flow statement tracks the inflows and outflows of cash and cash equivalents during a period, providing insights into a company’s liquidity and solvency.

Ratio Analysis

Liquidity Ratios

Measure a company’s ability to meet its short-term obligations using its liquid assets, such as the current ratio and quick ratio.

Solvency Ratios

Evaluate a company’s long-term financial viability and ability to meet its long-term obligations, such as the debt-to-equity ratio and interest coverage ratio.

Profitability Ratios – Accounting Equation

Assess a company’s ability to generate profits relative to its revenue, assets, or equity, such as the return on equity and profit margin.

Efficiency Ratios

Measure how effectively a company utilizes its assets and resources to generate sales or profits, such as inventory turnover and asset turnover.

Limitations and Criticisms of the Accounting Equation

Assumptions and Simplifications

The accounting equation relies on certain assumptions and simplifications, such as the historical cost principle. These issues may not always reflect the true economic substance of transactions.

Non-financial Factors

The accounting equation focuses solely on financial data and may overlook non-financial factors that can impact a company’s performance and value, such as environmental sustainability, corporate governance, and social responsibility.

Complexity of Certain Transactions – Accounting Equation

Some transactions may be complex or involve multiple parties, making it challenging to accurately capture their effects on the accounting equation. Examples include mergers and acquisitions, joint ventures, and derivatives contracts.

Impact of External Factors

External factors, such as changes in economic conditions, regulatory requirements, and industry trends, can influence the reliability and relevance of financial information, potentially distorting the balance of the accounting equation.

Advanced Concepts

Accrual Accounting vs. Cash Accounting

Accrual accounting recognizes revenue and expenses when they are earned or incurred, regardless of when cash is received or paid, whereas cash accounting records transactions only when cash changes hands.

Depreciation and Amortization

Depreciation and amortization are methods used to allocate the cost of tangible and intangible assets over their useful lives. Therefore, it reflects the consumption of economic benefits over time.

Adjusting Entries and Closing Entries

Adjusting entries are made at the end of an accounting period to ensure that revenues and expenses are properly matched while closing entries are made to transfer temporary account balances to permanent accounts at the end of the reporting period.

Consolidation and Intercompany Transactions

Consolidation involves combining the financial statements of parent and subsidiary companies into a single set of financial statements. Whereas, intercompany transactions refer to transactions between affiliated entities within the same corporate group.

Accounting Equation – Is It Worth the Hype?

Throughout this guide, we’ve explored the intricacies of the accounting equation and its profound implications for financial analysis and decision-making. From its basic components to advanced applications, the accounting equation serves as a powerful tool for understanding the financial health and performance of businesses.

By understanding its principles and applications, individuals and organizations can unlock the power of the accounting equation for informed decision-making. Furthermore, it enhances transparency and accountability to achieve long-term success in today’s dynamic and competitive business environment.